We live in a world filled with financial uncertainties and ever-expanding opportunities, where mastering the art of finance has become a necessity. We understand that managing your finances and budgeting can be a daunting task. So, we’ve brought you a guide to help you create the perfect budget plan for yourself. Whether you’re striving for financial independence, saving for that dream vacation, or simply looking to gain more control over your money, we have got your back. Come create a budget plan with us.

- Set Short-Term and Long-Term Goals:

The first step is to create short-term and long-term goals. These are goals that should make you feel happy, satisfied, and safe for the foreseeable future. Ask yourself what you want in the near future and a few years. While creating short-term goals, make sure you set aside enough money to cover at least 3 months of your living expenses, pay off your credit card bills, and limit their usage, for long-term goals save at least 10% of your gross salary for plans such as the down payment of a new house or car, education, retirement, etc. You can use your planner to reflect and write down your goals.

- Create a Budget Plan:

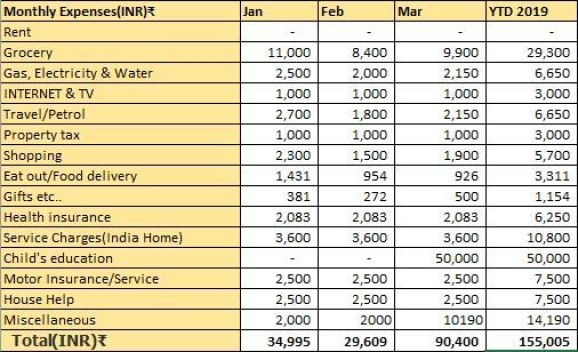

Creating a budget can be a horrifying subject for most, but to gain financial freedom and not be under the weight of debts, you have to make sure you track your expenses. The key is to not spend more than you bring in. Create a list of all your expenses and write down the amount you spend adjacent to it. This can include

- Savings

- Loans

- Insurances

- EMIs

- Monthly bills

- Groceries

- Gasoline

- Internet

- Phone

- Entertainment and Shopping

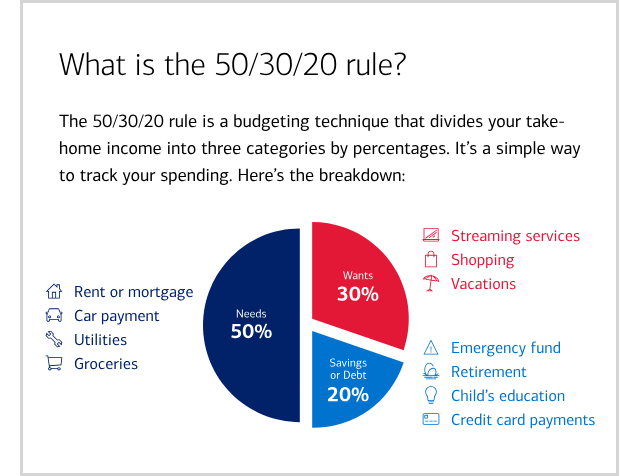

Add up these expenses and analyze if there are any places where you can spend less or invest more. You can also use the 50/30/20 budget rule if you do not understand where to put your money.

- Build an Emergency Fund:

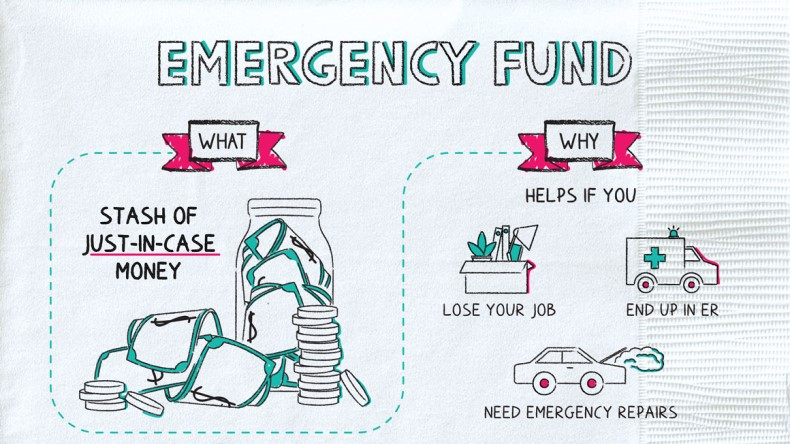

One more way to reduce financial stress is to create an emergency fund. If you are someone who’s constantly in debt or cannot save enough money, this can seem like a task. But setting aside just a small amount of money shouldn’t be that difficult. You can also create a separate savings account, transferring money each month from your current account. Creating a separate account will keep you from the temptation to use that money. You can also set up an auto-transfer system that would automatically transfer your money each month. The goal is to save up enough money to cover your living expenses for three to six months. This money can be used during an emergency such as unexpected medical bills, sudden home or car repairs, etc.

- Make the most of your Savings:

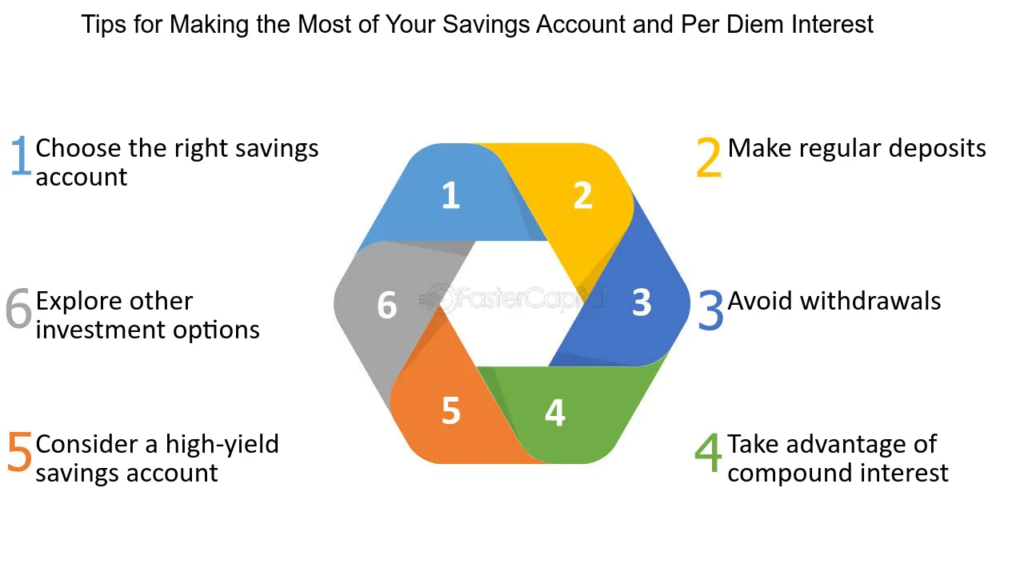

Budgeting or Financing is more than just saving more than you earn. You have to be smart with your choices and how you spend money. The best way to save your money is comparison shopping, comparing different sites and store prices for a product or service, and saving by spending on cheaper alternatives. You can also try out various extensions that scan for coupon codes on different websites such as Honey and Karma, allowing you to save a few extra bucks. Pay off credit card debts and spend on minimum monthly bills. Invest in places with high-yielding returns and keep repeating the process. Track your expenses regularly to understand where to hold back and spend less and where to invest more. You can track them in your planners or use free tracking apps. Keep repeating the process each month.

- Limit your Credit Card Purchases:

Credit card is a bad spender’s worst enemy. If you are someone who just cannot resist spending money on stuff and ends up using your credit card every time you run out of cash, you’re in trouble. You turn to your credit card without considering whether you can pay off those expenses. Resist the urge to spend money using your credit card on unnecessary items and purchases. This will save you a lot of money in the long run.

These are a few easy tips to help you manage your finances and create a budget that sticks. But these are just the basics, if you want us to go more in detail with this blog, comment down below about what would you like to learn more of and we’ll create another blog for you. Till then Happy Planning!!